Diving into the realm of profitable trading demands a firm grasp on technical analysis. It intricate discipline involves deciphering price patterns and market indicators to predict future price movements. By zeroing in on historical data, traders can identify trends, support and resistance levels, and other crucial signals that suggest potential trading opportunities. Mastering technical analysis is a ever-evolving process that requires dedication, practice, and a willingness to adjust strategies based on market volatility.

- Nonetheless, the rewards for mastering this art can be substantial. Skilled technical analysts possess the ability to identify high-probability trades, minimize risk, and ultimately achieve consistent profitability in the dynamic world of financial markets.

Enhance yourself with the knowledge and tools necessary to maneuver the complexities of technical analysis and unlock your true trading potential.

Automated Trading: Unleashing the Power of Algorithms

The realm of finance is constantly evolving, with technological advancements driving its future. At the forefront of this revolution stands automated trading, a paradigm shift that leverages the power of algorithms to execute trades with precision. Traders worldwide are increasingly implementing this innovative approach to capitalize on market opportunities and minimize risks. Automated trading systems analyze vast datasets, identify patterns, and create actionable insights with unmatched efficiency. This allows traders to react to market fluctuations in real time, executing trades at optimal moments.

The benefits of automated trading are extensive. By reducing human emotion from the equation, algorithms make rational decisions based on predefined parameters. This translates in increased profitability and consistent returns over the long term. Moreover, automated systems can operate 24/7, tracking market trends and identifying opportunities that might be missed by human traders.

Additionally, automated trading platforms provide advanced tools for backtesting strategies, adjusting parameters, and overseeing risk exposure. This enables traders to build a robust trading strategy that aligns with their specific goals.

Unlocking The Moving Average Crossover Strategy

The moving average crossover strategy is a popular technique used by traders to pinpoint potential buying and selling opportunities in financial markets. This tactic relies on the intersection of two or more moving averages, typically short-term and long-term, to generate trading signals. When a shorter-term moving average surpasses a longer-term moving average, it often indicates a potential bullish trend, prompting traders to purchase long positions. Conversely, when the shorter-term moving average falls below the longer-term moving average, it may point towards a bearish trend, leading traders to short their positions.

While the moving average crossover strategy is relatively simple, its effectiveness can be improved by incorporating other technical indicators and risk management techniques. Traders should also carefully consider market situations and their own appetite for risk before implementing this strategy.

Technical Indicators: Your Guide to Market Insights

Navigating the volatile world of finance could be a daunting task. To make informed decisions and potentially maximize your profits, understanding market trends is crucial. This is where technical indicators come into play. These quantitative tools evaluate historical price and volume data to identify patterns and signals that may indicate future price movements. By leveraging these insights, traders have the ability to gain a deeper understanding of market sentiment and make more calculated trading choices.

- Popular technical indicators include moving averages, which average price data over a specified period, revealing underlying trends.

- Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate oversold conditions.

- Additionally, MACD identifies momentum shifts and potential trend reversals by comparing two moving averages.

Remember that technical indicators should be used in conjunction with other research. Always conduct thorough research before making any trading decisions.

Crafting Winning Automated Trading Strategies

Developing effective automated trading strategies requires a careful blend of technical expertise and market understanding.

Traders must meticulously analyze historical price data to identify patterns and trends that can predict future market movements.

Implementing robust risk management protocols is essential to mitigate potential losses and ensure the long-term viability of trading algorithms.

Continuously evaluating strategies based on real-time market conditions allows traders to adapt their approach and maximize returns.

Delving into Beyond the Charts: Advanced Technical Analysis Techniques

For seasoned traders seeking an edge, venturing past the realm of basic charts is essential. Advanced technical analysis techniques empower you to identify hidden patterns and trends, delivering invaluable insights for Ichimoku Cloud Strategy informed decision-making. These strategies often involve complex chart formations, indicators, and robust analytical tools that go deeper the surface, allowing you to predict market movements with greater accuracy.

- Harnessing Elliott Wave Theory can expose recurring patterns in price action, helping you recognize potential trend reversals and continuations.

- Retracement levels provide a framework for understanding market pullbacks, allowing you to place trades at optimal entry and exit points.

- Stochastic Oscillators can strengthen trend signals and reveal potential overbought or oversold conditions.

With embracing these advanced techniques, traders can amplify their analytical capabilities and master the complexities of financial markets with greater confidence and success.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Sam Woods Then & Now!

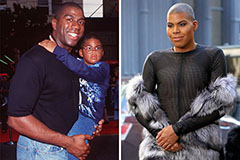

Sam Woods Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!